Introduction

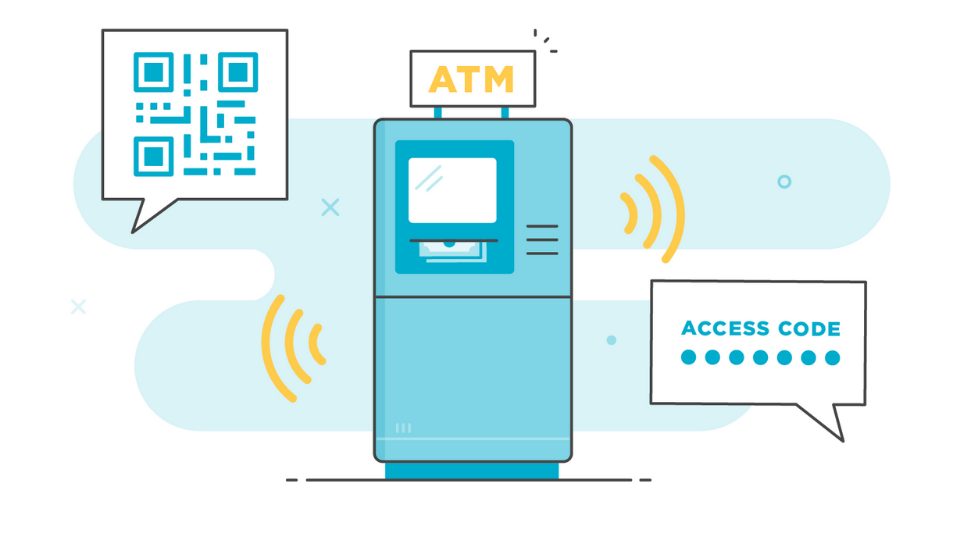

QR codes have transformed the way we interact with various industries, and the financial services sector is no exception. With their ability to securely store and transmit information, QR codes are revolutionizing the way financial transactions are conducted. From payments to account management, this article explores the growing role of QR codes in financial services and how they simplify transactions while ensuring security.

Convenient Mobile Payments

QR codes have emerged as a popular method for facilitating mobile payments. Customers can simply scan a QR code displayed at a point of sale, on invoices, or within a mobile app to initiate a payment. By linking the QR code to the customer’s digital wallet or bank account, the payment process becomes seamless, eliminating the need for physical cards or cash. QR code payments offer speed, convenience, and a contactless experience, catering to the growing preference for digital transactions.

Enhanced Security Measures

One of the key advantages of QR codes in financial services is the enhanced security they offer. QR codes can be encrypted and include digital signatures, making them difficult to counterfeit or tamper with. This ensures the integrity of the transaction and protects sensitive financial information. Additionally, QR codes can incorporate tokenization, a process that replaces actual card or account numbers with unique tokens, further bolstering security by preventing data breaches or identity theft.

Streamlined Account Management

QR codes streamline account management processes for financial institutions and their customers. Customers can scan a QR code to access their account information, view transaction histories, or update personal details. This eliminates the need for lengthy login procedures and improves the overall user experience. Financial institutions can also generate QR codes to securely deliver statements, tax documents, or other sensitive information directly to customers, reducing paperwork and enhancing data privacy.

Efficient Customer Onboarding

QR codes facilitate efficient customer onboarding processes, particularly for new account openings or loan applications. Financial institutions can provide customers with personalized QR codes that contain pre-filled application forms. Customers can scan these codes using their mobile devices, eliminating the need to manually enter personal information. This streamlines the onboarding process, reduces errors, and accelerates the time it takes to complete applications, enhancing customer satisfaction.

Access to Real-Time Information

QR codes enable customers to access real-time financial information and market updates. Financial institutions can provide QR codes on physical signage or within their mobile applications, giving customers instant access to stock prices, exchange rates, or investment performance. This empowers customers to make informed financial decisions on the go, without the need for extensive research or multiple logins.

Personalized Marketing and Offers

Financial institutions can leverage QR codes to deliver personalized marketing messages and offers to their customers. By integrating QR codes into marketing materials, such as emails, newsletters, or direct mailings, institutions can link customers directly to customized landing pages or promotional content. This targeted approach enhances customer engagement, increases the likelihood of conversion, and strengthens the overall customer relationship.

Conclusion

QR codes are transforming the financial services industry by simplifying transactions while ensuring security. From convenient mobile payments to streamlined account management and efficient customer onboarding, QR codes offer speed, convenience, and enhanced user experiences. As financial institutions continue to embrace digital transformation, QR codes will play an increasingly important role in providing secure and seamless financial services to customers, fostering trust, and driving innovation in the financial industry.